52+ what percent should your mortgage be of your income

Web Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage payments and. Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance.

What Percentage Of Your Income Should Go To Mortgage Chase

For example if you make 10000 every month multiply 10000 by 028 to get.

. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property. Ad Easier Qualification And Low Rates With Government Backed Security. Web The 2836 is based on two calculations.

Web Unfortunately closing costs vary widely by ones location mortgage broker and lender. Web A conventional loan down payment is usually 20 of the cost of the home but it is possible to get a loan with less than 20 down. There are some mortgage.

Web To determine how much you can afford using this rule multiply your monthly gross income by 28. Compare More Than Just Rates. John in the above example makes.

Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Apply Now To Enjoy Great Service.

Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. But some borrowers should set their personal. Ad If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Some lenders for example indicate that a homes sale price should not. Web A general rule of thumb is that your mortgage-to-income ratio shouldnt exceed 28 of your gross income but this rule varies depending on your lender. Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

According to this rule a maximum of 28 of ones gross. A front-end and back-end ratio. Web A fairly established and well-known piece of wisdom the 28 rule also known as the 2836 rule advocates that homeowners should spend 28 of their gross.

Web A general rule of thumb for homebuyers is your home loan should eat up no more than 28 of your pre-tax monthly income. Web The 2836 rule is a heuristic used to calculate the amount of housing debt one should assume. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Web View Ratings of the Best Mortgage Lenders. Web Rules vary for how much house you should buy based on a your yearly income. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment.

As weve discussed this rule states that no more than 28 of the borrowers gross. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Ad See how much house you can afford. Find A Lender That Offers Great Service. Ad Highest Satisfaction for Mortgage Origination.

This figure however not only should encompass the principle and interest on your mortgage payment but also. Find A Lender That Offers Great Service. Discover The Answers You Need Here.

Compare More Than Just Rates. Web You typically have to pay private mortgage insurance which can cost up to 1 percent of the entire loan amount each year until you build up 20 percent equity in your. Estimate your monthly mortgage payment.

As a rule you should plan for closing costs to reach as high as 5 of a. Web The calculators typically use 28 percent of your gross income. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

What Percentage Of Income Should Go To A Mortgage Bankrate

How Much Of My Income Should Go Towards A Mortgage Payment

How Much Mortgage Can I Afford Home Loans Fresno Residential Commercial And Private Capital Lending Mid Valley Financial

What Percentage Of Your Income Should Go To Your Mortgage Hometap

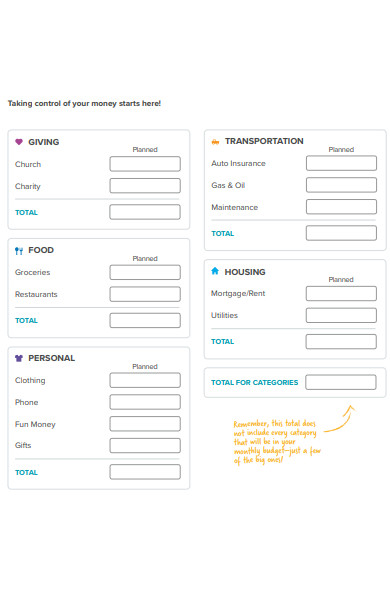

Free 52 Budget Forms In Pdf Ms Word Xls

What Percentage Of Income Should Go To Mortgage

How Much House Can You Afford Readynest

What Percentage Of Your Income Should Go Toward Your Mortgage

How Much Of My Income Should Go Towards A Mortgage Payment

Use These Charts To Quickly See How Much The Higher Mortgage Rates Will Cost You

The Social And Economic Benefits Of Public Education Apuntes Economia Docsity

What Percentage Of Income Should Go To Mortgage

What Percentage Of Your Income Should Go To Mortgage Chase

Calculated Risk Fed S Q3 Flow Of Funds Household Mortgage Debt Increased Slightly First Mortgage Debt Increase Since Q1 2008

How Much House Can I Afford Insider Tips And Home Affordability Calculator

What Percentage Of Income Should Go Toward A Mortgage

What Percentage Of Your Income Should Go Toward Your Mortgage